Sustainability

Governance

Sustainability ─ Governance

Corporate Governance

Since its establishment, our company has upheld the corporate philosophy of ” to provide a mechanism that embodies the value of information.” We share this philosophy across the group, considering it a foundation for managerial decisions. Recognizing the necessity of establishing sound management, legality, and transparency for sustainable growth and development, our group aims to build a management structure as a fundamental principle in our corporate governance initiatives.

In pursuit of this realization, we are committed to fostering a swift and appropriate decision-making process, exercising independent audit functions, constructing effective internal control systems, and promoting timely and appropriate information disclosure. Moreover, we are dedicated to instilling a heightened awareness of social responsibility among all employees. We also acknowledge and adhere to the basic principles of the Corporate Governance Code, striving to enhance the robustness of our corporate governance.

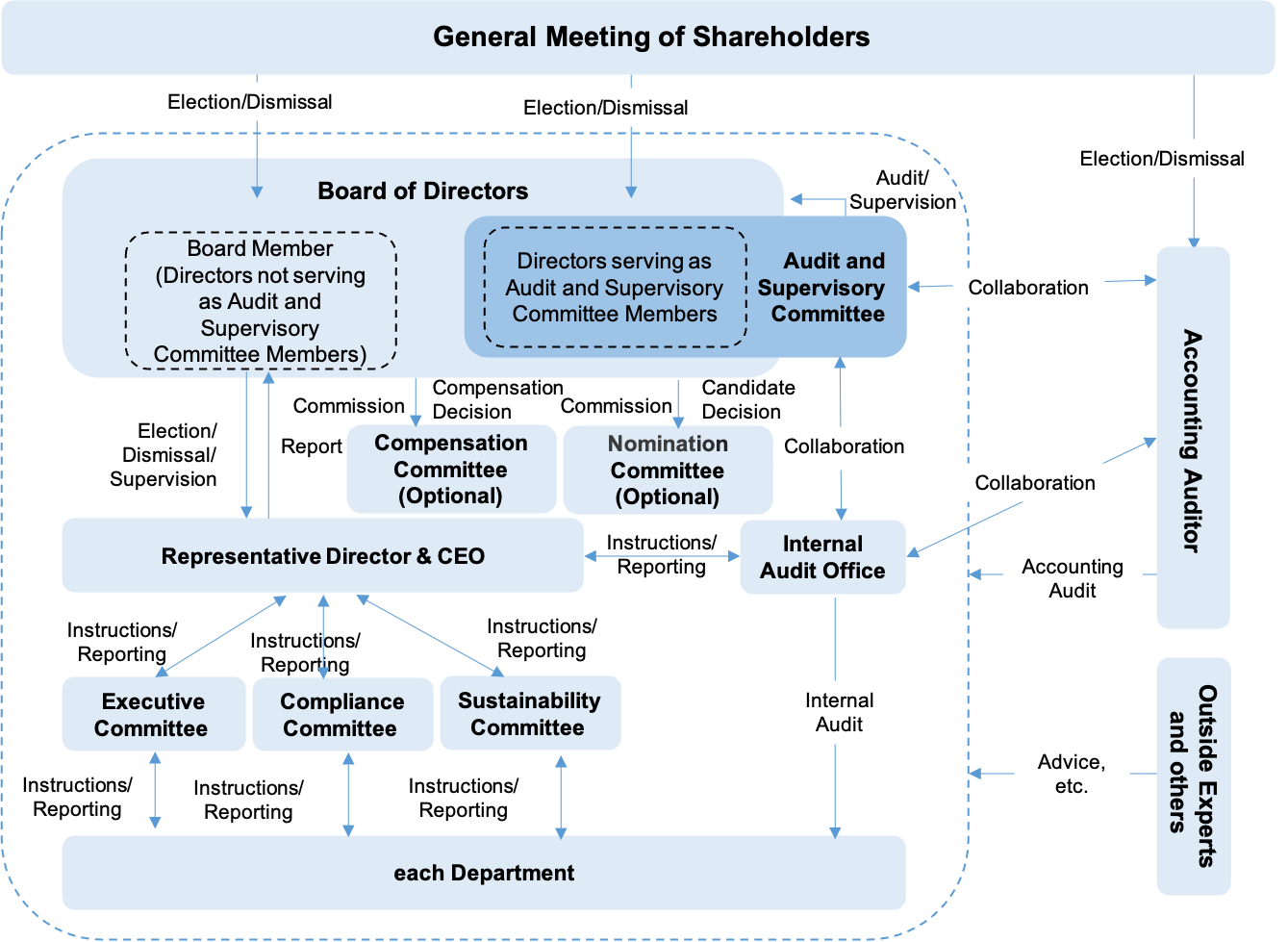

Corporate Governance Structure (Execution and Oversight of Operations)

Our organizational design incorporates a Board of Directors, an Audit and Supervisory Committee, and the appointment of an accounting auditor, positioning an Internal Audit Department under the direct control of the President. We aim to strengthen and maintain Corporate Governance based on these components.

The Audit and Supervisory Committee, consisting of external directors with voting rights in the Board of Directors, maintains a separation of business execution and oversight, ensuring a robust supervisory function.

The Board of Directors, an optionally established body with a majority of independent external directors, has established a Compensation Committee and a Nomination Committee. This structure enhances transparency and objectivity in the decision-making process for the compensation of directors (excluding directors serving on the Audit and Supervisory Committee) and the selection and dismissal of directors.

Regarding director terms, non-Audit and Supervisory Committee directors serve for one year, while Audit and Supervisory Committee directors serve for two years, both subject to shareholder resolutions at the general meeting.

The Management Council comprises executive officers with the attendance of full-time Audit and Supervisory Committee members, ensuring swift decision-making and operational efficiency. The Sustainability Committee convenes quarterly to discuss risk identification, assessment, and management related to climate change, as well as to formulate fundamental policies, strategies, and materiality decisions for sustainability management. While there is no dedicated internal audit personnel, the Internal Audit Department operates independently under the President’s direct control to ensure a robust audit structure, with precautions taken to avoid auditing departments to which the auditors belong. Collaboration with the Audit and Supervisory Committee and the accounting auditor is maintained to ensure the effectiveness of the three-tiered audit system.

Additionally, for critical legal judgments in the decision-making process, we collaborate with legal advisors. This close cooperation among these bodies ensures the integrity, transparency, legality, and efficiency of management and business execution.

Board of Directors

The number of directors stipulated in the Articles of Incorporation is 15. Currently, the Board of Directors consists of 4 directors (excluding outside directors and Audit and Supervisory Committee members), 3 directors who are the Audit and Supervisory Committee members (outside directors), and 3 outside directors, and meets by the middle of each month to make decisions on important matters and report on business conditions.

Materials are distributed in advance to ensure that each director has sufficient time to review and consider each agenda item and reports, and the Audit and Supervisory Committee, which meets prior to the Board of Directors’ meetings, forms its own opinions as appropriate. At the Board of Directors’ meetings, each director expresses his/her honest opinions and sound discussions are held, and the directors audit and supervise each other in the execution of their duties.

The chairperson of the Board of Directors is CEO, except as otherwise provided by law, in accordance with the Articles of Incorporation and the Regulations of the Board of Directors.

Audit and Supervisory Committee

The Audit and Supervisory Committee is currently composed of three external directors and meets prior to the Board of Directors’ meetings. One of the audit and supervisory committee members is a full-time member, and they participate in weekly management council and review proposals, ensuring that regular audits are conducted. We believe that this fulfills an important governance function.

<Attendance Record>

| Total Meetings | Sumita | Uryu | Saito | Ban | Takada | Noma | Maki | Hamano | Ishibashi | Yoshimura | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

FY2024 -2024.03 | 19 | Number of attendances | – | 19 | – | 19 | 19 | – | – | 17 | 19 | 19 |

| % of attendance | – | 100% | – | 100% | 100% | – | – | 89% | 100% | 100% | ||

FY2023 -2023.03 | 17 | Number of attendances | 13 | 17 | 17 | 17 | 17 | 16 | 12 | 17 | 17 | 17 |

| % of attendance | 76% | 100% | 100% | 100% | 100% | 94% | 70% | 100% | 100% | 100% | ||

FY2022 -2022.03 | 19 | Number of attendances | – | 19 | 14 | 19 | 19 | 14 | – | 19 | 19 | 19 |

| % of attendance | – | 100% | 73% | 100% | 100% | 73% | – | 100% | 100% | 100% | ||

“The Chairman of the Board, Makoto Sumita, and Director Noriko Maki were elected for the fiscal year ending in March 2023.”

<Attendance Record>

| Total Meetings | Hamano | Ishibashi | Yoshimura | ||

|---|---|---|---|---|---|

FY2024 -2024.03 | 14 | Number of attendances | 14 | 14 | 14 |

| % of attendance | 100% | 100% | 100% | ||

FY2023 -2023.03 | 14 | Number of attendances | 14 | 14 | 14 |

| % of attendance | 100% | 100% | 100% | ||

FY2022 -2022.03 | 14 | Number of attendances | 14 | 14 | 14 |

| % of attendance | 100% | 100% | 100% | ||

Assessment of the Effectiveness of the Board of Directors

To improve the effectiveness of the Board of Directors (including the Nomination and Compensation Committee, which is established as non-statuary bodies), the Company conducts a self-evaluation through a questionnaire to all directors once a year in principle, and the results are discussed and evaluated by the Board of Directors. Through the evaluation for the fiscal year ended March 31, 2022, the Company confirmed that the Board of Directors is functioning effectively as an executive and supervisory body, and that the effectiveness of the Board of Directors is ensured. Regarding the appointment of female directors and outside directors who are not members of the Audit and Supervisory Committee in consideration of the diversity of the Board of Directors and the balance of knowledge and experience, the appointment of Makoto Sumida, former Chairman of the Board of Directors of TDK Corporation, and Noriko Maki, former anchor of TV Tokyo Corporation, as outside directors was approved at the Annual General Shareholders’ Meeting in June 2022. Meanwhile, in anticipation of the acceleration of digitalization and the rapid expansion and diversification of the Company’s business, some commented on the importance of ensuring agility to secure business opportunities while maintaining the governance focusing on risk management, as well as the importance of strengthening deliberations on medium- to long-term growth strategies. Based on these comments, the Board of Directors has identified the challenges for this fiscal year that is useful to consider efforts for digital transformation and an appropriate delegation from the Board of Directors to the management team.

Executive Compensation

Although the Company has not introduced a specific calculation method for the amount of remuneration for directors, it is determined within the limits of the total amount separately approved at the General Shareholders’ Meeting for directors who are and who are not members of the Audit and Supervisory Committee. The remuneration for each individual director who is not a member of the Audit and Supervisory Committee is discussed and determined by the Compensation Committee chaired by an independent outside director, and for directors who are members of the Audit and Supervisory Committee is discussed and determined by the Audit and Supervisory Committee.

To ensure fairness, objectivity, and transparency in the compensation policy, allocation system, and operation, the Board of Directors delegates the Compensation Committee to determine the individual compensation, which is a non-statuary body with members appointed among the directors by resolution of the Board of Directors and more than half are independent outside directors. The chairman of the Committee is also selected by resolution of the Board of Directors.

Although the Company has not introduced a specific calculation method for the amount of remuneration for directors, it is determined within the limits of the total amount separately approved at the General Shareholders’ Meeting for directors who are and who are not members of the Audit and Supervisory Committee. The remuneration for each individual director who is not a member of the Audit and Supervisory Committee is discussed and determined by the Compensation Committee chaired by an independent outside director, and for directors who are members of the Audit and Supervisory Committee is discussed and determined by the Audit and Supervisory Committee.

To ensure fairness, objectivity, and transparency in the compensation policy, allocation system, and operation, the Board of Directors delegates the Compensation Committee to determine the individual compensation, which is a non-statuary body with members appointed among the directors by resolution of the Board of Directors and more than half are independent outside directors. The chairman of the Committee is also selected by resolution of the Board of Directors.

<FY2023 Total amount of compensation for directors>

| Number of Directors paid | Compensation (JPY000s) | Bonuses | Amount of Compensation etc. (JPY000s) | |

|---|---|---|---|---|

| Director (excluding Audit and Supervisory Committee member) (outside director) | 7 (3) | 192,664 (13,815) | - (-) | 192,664 (13,815) |

| Director (Audit and Supervisory Committee member) (outside director) | 3 (3) | 20,040 (20,040) | - (-) | 20,040 (20,040) |

| Total (outside director) | 10 (6) | 212,704 (33,855) | - (-) | 212,704 (33,855) |

*The above total amount of remuneration includes the company’s share of the defined contribution pension plan.

Accounting Auditor’s Compensation

Audit fees for certified public accountants are determined with the consent of the Audit and Supervisory Committee, taking into consideration the number of audit days, size of the audit, etc.

<Amount of remuneration>

| Accounting Auditor’s Compensation | Amount of remuneration | Total of cash and other profits payable by the Company to Accounting Auditor |

|---|---|---|

| fiscal year ended March 31, 2023 | JPY 46 million | JPY 46 million |

| fiscal year ended March 31, 2022 | JPY 35 million | JPY 35 million |

| fiscal year ended March 31, 2021 | JPY 31 million | JPY 31 million |

* In the audit contract between the Company and the accounting auditor, the amount of remuneration. for the audit based on the Companies Act and the audit based on the Financial Instruments and Exchange Act are not clearly separated and cannot be practically separated, thus the accounting auditor remuneration amount under review is the total of these amounts.

Ownership

All of the Company’s issued shares are identical and have full voting rights, and the number of shares per unit is 100 shares without any rights limitation.

The Company believes that those who control its decisions on financial and business policies should aim sustainable growth and concentrate their management resources on maximizing its corporate value and increasing shareholder’s profit.The Company has not introduced any special takeover defense.

The Company classifies investment shares held for the purpose of earning profits from the value changes of shares and dividends as net investment, and other shares as investment shares for the purpose other than net investment (strategic holdings).

The Company have a basic policy to dispose of or reduce our holdings of policy-owned stocks that are considered to have little significance in light of the business situation.

We conduct verification of economic rationality, considering factors such as the amount, and discuss at management meetings or the board of directors, and decide on actions such as sale after considering options.

With respect to the exercise the voting rights of shares held, the Company will decide whether to approve or disapprove of a proposal, considering whether the proposal will contribute to the enhancement of the medium- to long-term corporate value and the realization of sustainable growth and enhancement of corporate value of the Group, while respecting the management policies, strategies, etc., of the issuing company.

Risk Management

In order to mitigate and prevent risks, the Company is enhancing to strengthen its risk management system and ensure compliance through the establishment of risk management regulations and meetings of the Compliance Committee. In the event of an unforeseen situation, a task force shall be established headed by the President and Representative Director to take prompt action putting in place a system to prevent and minimize the spread of damage. In addition, the Sustainability Committee is enhancing to reduce risks and maximize opportunities under appropriate sustainability risk management including the identification, assessment, and management of climate changes risks.

Initiatives for Personal Information Security

The Group Company mainly utilizes IT to acquire and provide information via internet. We recognize the importance of ensuring various information security, including personal information. The Company established an “Information Security Standards” to protect confidentiality, integrity, and availability of Company information assets and to minimum impact of any possible accidents. The Company also conducts information security trainings for all Group employees to improve information security literacy.

The Company constantly reviews measures and operations towards various external threats. Installations of security software and terminal control on all internal PCs and devices, and IDaaS and other systems have been implemented. This prevents and detects unauthorized accesses or multi-factor authorization.

As part of our continuous efforts, each Group Companies have been certified Privacy Mark or/and ISMS (Information Security Management System.)

Compliance

In order to ensure compliance with laws and regulations, corporate ethics, and internal rules in business activities, we have established a “Basic Compliance Policy” that sets out the basic matters to be complied with, and make them known to the officers and employees of our group.

As a specific code of conduct, the Company has established a Basic Compliance Policy which shall comply with laws and regulations, industry self-regulation, and company rules.

The policy also conducts fair and transparent corporate activities that do not violate social rules. It also maintain appropriate and transparent business operations, respecting human rights and the environment, and protecting reporting and whistleblowers.

Prevention of Corruption

In accordance with the Basic Compliance Policy, the Group Companies will not engage in any illegitimate activities whether directly or indirectly, bribery, kickbacks, inappropriate entertainment and gifts, and illegal political donations, contributions, and sponsorships.

Basic Policy for Eliminating Organized Crime Groups and Status of Implementation

Based on our Basic Compliance Policy, the Group Companies take a firm stand on countering organized crime groups and established a system to eliminate organized crime groups by fully cooperating and sharing information with external specialized organizations such as police authorities, the federation of special anti-violence countermeasures of which is organized by the Metropolitan Police Department, and legal advisors.

Tax Policy

Each Group Companies have fulfilled tax obligations and have continued to secure stable profits for appropriate tax payments. In addition, the Company complies with the laws and regulations of each country the international organizations’ standards and OECD Transfer Pricing Guidelines. We fully pay appropriate taxes in various transactions. The Company currently does not have any overseas subsidiaries and does not engage in any transactions that could lead to tax avoidance, including tax havens.

Ensuring Compliance

The Company has established a Compliance Committee to ensure and determine policies for its Group Companies. It monitors specific matters to be complied within the execution of duties, such as laws and regulations, the Articles of Incorporation, internal regulations, and the Code of Conduct. Committee also established a system to prevent compliance violations.

The Company regularly provides compliance training for all employees including management, in laws and regulations that need to be understood for our business sustainability. The Company continuously raises employees’ awareness through regular insider trading regulations and harassment programs.

Periodically conduct internal audits to ensure that the execution of their respective duties is in compliance with laws and regulations and the Articles of Incorporation.

Hotline

We respond to the Whistleblower Protection Act in accordance with the “Whistleblower Handling Rules,”. The Company emphasizes on compliance management through early detection and correction of fraudulent activities by establishing an environment where whistleblowers can easily consult with internal and external multiple reporting windows by phone or email.